Clearpay introduces cross-border commerce for merchant partners

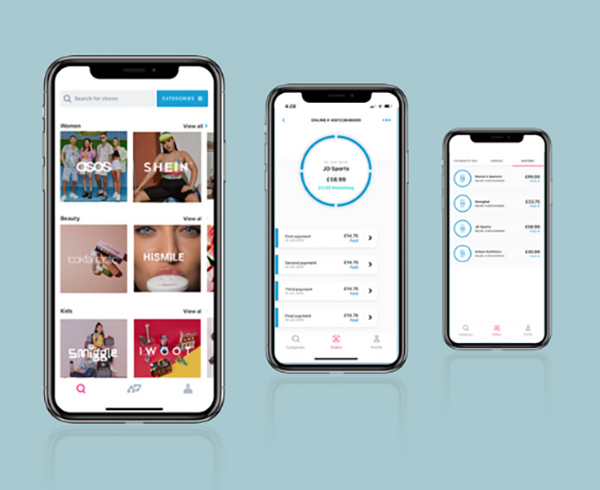

Clearpay merchant partners can now offer the payment provider's Buy Now, Pay Later products to customers across the world.

The move means that merchants can open their e-commerce sites to Australian, British, Canadian and New Zealand customers with the US being added next year.

According to Clearpay, which is known outside of the UK as Afterpay, cross-border shopping represents a $1 trillion GMV (gross merchandise value) opportunity. With the cross-border option, shoppers will see items in their local currency and at checkout will be able to opt to in four instalments over time, "without incurring interest, fees or revolving and extended debt".

Participating retailers can open their storefronts to these shoppers without paying set up or currency conversion fees.

Clearpay first introduced cross border shopping in its home market of Australia and New Zealand (ANZ) in March 2019, which it said delivered year-on-year sales growth of nearly 576%. Because of such strong consumer demand, the number of ANZ merchants that were now selling outside their home country had grown 10 times, it added.

"We have been very pleased with our cross-border implementation. It has been seamless and very effective in scaling our efforts abroad as we grow globally,” commented Justin Gaggino of Hi-Smile, an early adopter of Clearpay’s cross border offering. “We have seen an approximately 30% increase in overall orders come through our cross border partnership with Clearpay.”

“Cross border trade allows retailers to open their storefronts to the world - delivering new customers, higher conversion and ultimately more merchant sales, without additional set-up costs or fees,” said Nick Molnar, Clearpay’s Co-founder.

“We are particularly excited to offer cross border capabilities at a time when consumers are buying online more than ever and in advance of this busy Christmas shopping season," Molnar added.

Yesterday new research from comparethemarket.com revealed that more consumers, in particular young consumers, have been turning to Buy Now, Pay Later schemes during the pandemic.