In Depth: Why supermarkets are betting on beauty

A number of British supermarkets have been elevating their beauty offer in recent years, helping to transform them into more credible beauty retail destinations for consumers.

TheIndustry.beauty explores how and why supermarkets are improving their beauty offer, with insights and advice from retail trend analyst Wizz Selvey.

Earlier this year, data from comparison site Idealo revealed that Brits are continuing to splurge on small luxuries such as cosmetics despite the cost-of-living crisis. The data supports the 'lipstick effect', which describes how during times of financial crisis people tend to spend more money on small luxuries to bring them comfort.

With this in mind, beauty is proving an attractive opportunity for supermarkets like Sainsbury's, Tesco and Aldi as they continue to invest in the category.

"Beauty typically holds a higher profit margin for supermarkets than food, particularly as we have seen profits in food squeezed over the cost-of-living crisis," says Selvey.

"By expanding their beauty offer, supermarkets can encourage shoppers to increase their spend in one transaction. Beauty is also historically the most buoyant category in a recession, whilst the fashion and home categories have taken a downturn."

Supermarkets offer a different retail environment from dedicated beauty stores – they cannot provide the same volume of product or expert-led assistance as the likes of Boots and Sephora, or even department stores such as John Lewis and Selfridges. Therefore, supermarkets are increasingly investing in visual merchandising to win customers over.

"Many supermarkets are getting savvy on categorising their beauty products, making this part of the store feel more like a destination through different trends and features," explains Selvey. This allows customers to better navigate their beauty offer, helping to drive sales as a result.

Sainsbury's has introduced a number of activations to improve its beauty offer in recent years, including the launch of new Serum Bars across 106 stores this summer.

The Serum Bars offer products exclusive to Sainsbury’s, as well as a wider choice of brands including Q+A, L'Oréal, CeraVe, Olay and Super Facialist. Influenced by the popularity of serums at the supermarket chain, the concept aims to help customers choose the right serum for their skincare needs through clear and helpful information.

"The biggest opportunity for supermarkets is elevating how customers navigate their beauty offer in a self-service environment, especially as the category expands and more brands are stocked," says Selvey. "Supermarkets aren't a place where shoppers often ask for advice or guidance, so signage and ‘shelf-talkers’ really help to show customers what they are looking for, how they navigate brands within categories, and options therein."

Tesco is another supermarket that has installed visuals to help customers navigate its beauty offer. In September, the business introduced a new sensitive skin section in selected stores across the UK. Created in partnership with Aveeno, the space aims to provide a 'one-stop shop' of products suitable for sensitive skin from brands such as Aveeno, E45, Cetaphil, Weleda, and Cetraben.

“This exciting new trial brings together brands and useful information to help the 40% of the UK population with sensitive skin find the right solution for them," Sarah Sturgeon, Category Buying Manager for Baby & Beauty at Tesco, said at the time.

"Most customers don’t know where to look in stores to find sensitive skin products – so when we learnt that the majority of customers want to find solutions alongside other familiar products in the skincare aisle, we created this new dedicated area in-store to make it easy to find the products they need all in one place.”

The sensitive skin section also falls under a new skincare zone that categorises products by skin type, including ‘sensitive face’, ‘normal to dry skin’, ‘very dry skin’ and ‘very dry, itchy skin’ – making it easier for Tesco's customers to find suitable products all in one place.

The introduction of Artificial Intelligence (AI) and Augmented Reality (AR) technology can also modernise the capabilities of supermarkets and the experiences they provide customers.

This technology is proving both popular and successful throughout the beauty industry because it can offer personalised experiences, aiming to make shopping much more targeted and easier for consumers - a helpful element in the more independent environment of a supermarket.

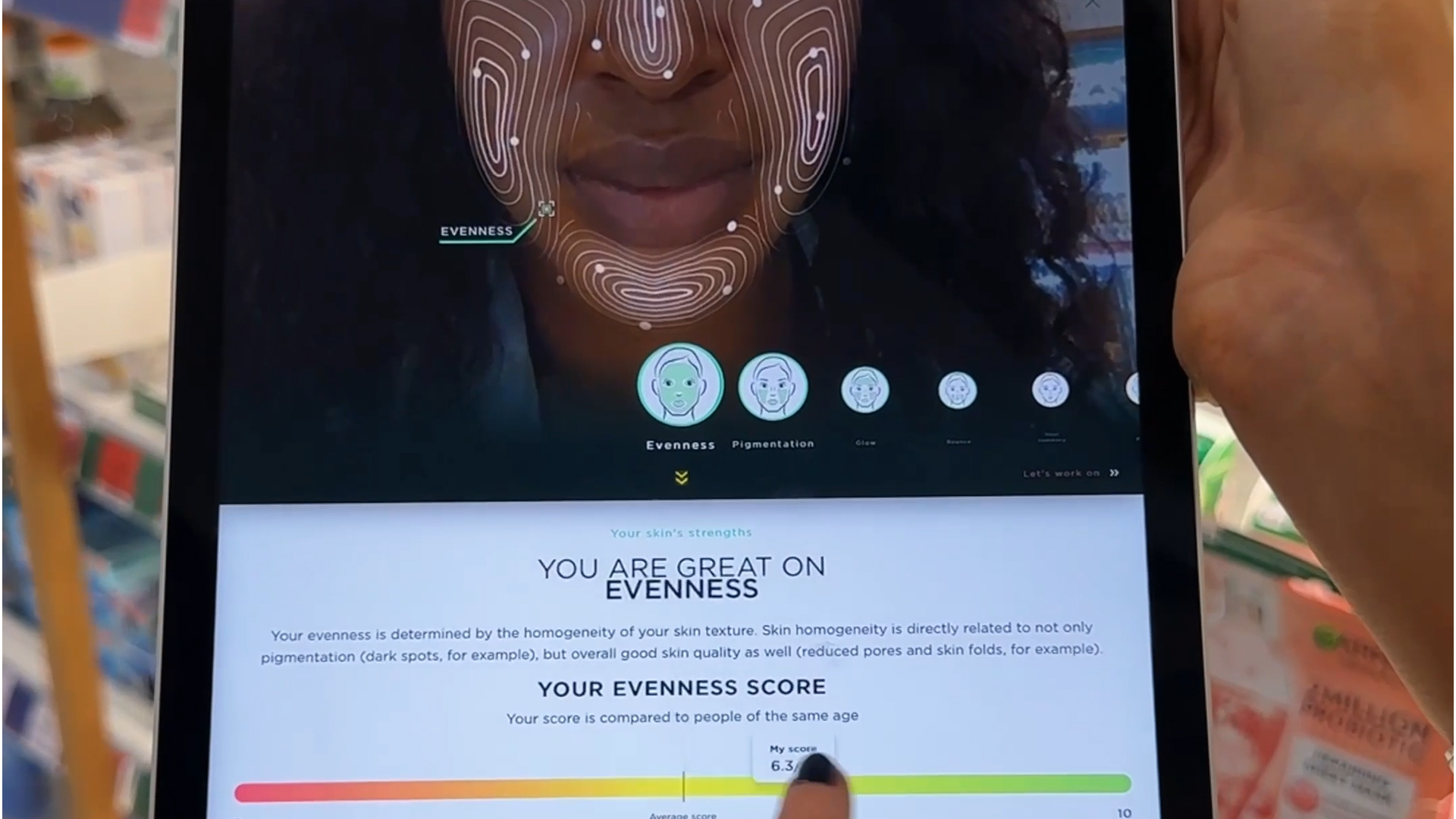

Offering another example, last year Sainsbury's partnered with Garnier and L'Oréal Paris to bring skincare consultations to over 100 UK stores. Scanning a customer's face to deliver tailored and personalised advice, the service seeks to make skincare recommendations more accessible as the category continues to grow and customers continue to prioritise skin health.

In addition to visual merchandising and tech-driven experiences, supermarkets can also elevate their beauty offer via brand and product mix – which can be influenced by customer demographic, location and store size.

While a business like Waitrose will typically stock a more premium offer for its more affluent customers, value chains such as Aldi or Lidl are known for their affordable alternatives to popular and more expensive beauty products - these 'beauty dupes' have grown in popularity over the years, often garnering a lot of interest on social media.

In fact, #AldiBeauty has reached over 30.3 million views on TikTok – showing that dupes can be a successful way to drive engagement and sales. From skincare and bodycare, to haircare and fragrance, Aldi frequently introduces various beauty dupes called 'Specialbuys' under its Lacura range.

As part of this, Aldi has been preparing to bring back some of its limited-edition Specialbuys from tomorrow, 30 November. After hitting the headlines earlier this year, the Lacura 2% BHA Toner – much like Paula’s Choice equivalents – is making a comeback ahead of Christmas. After selling out twice in a row, the Lacura Cleansing Balm – inspired by Emma Hardie – is also returning for a third time.

So, supermarkets are listening to customer demand to help appeal to shoppers. This is also supported by Tesco, which last week announced that customers can now order makeup and nail products online for the first time.

It sees over 300 items from Rimmel and Sally Hansen available for shoppers to order on both Home Delivery and Click+Collect alongside their weekly shop.

With thousands more products from brands including L’Oréal Paris and Maybelline to be added in the New Year, the launch hopes to "makes it more convenient than ever for customers to get everything they need when shopping at Tesco", it said in a statement.

The move comes in response to customer feedback, which found that ‘mascara’ was in the top 20 most searched-for products that weren’t available for home delivery on Tesco.com, along with searches for ‘Rimmel’ and ‘Maybelline’.

Tom Lye, Category Director for Health and Beauty at Tesco, said: “Customers tell us that they often search on our website and app for makeup and nail products, so we are incredibly excited to be able to answer their beauty needs for the first time, and bring customers even more of the products they are looking for at Tesco.”

However, Selvey highlights that the success of third-party brands at supermarkets is not only down to the chains themselves but also the individual brands.

"As with a lot of the brands I work with, who are trying to grow sales and build better relationships with retailers, it’s important that they are trading and marketing the brand with the retailers but also creating activations outside of the retailer to build sales and engagement," she emphasises.

"I see the future of supermarket beauty growing, many retailers are trying to get into beauty, some more successful than others. We will see winners and losers, as beauty is a hugely competitive market. I anticipate supermarkets will keep beauty as a revenue stream, some as a serious growth category."