The Body Shop: What went wrong and can it be saved?

The Body Shop is preparing to appoint administrators for its UK business, in a move likely to result in store closures and job losses.

Aurelius, the new private equity owner of the British brand, is looking to appoint FRP Advisory to manage the insolvency process and significantly restructure the high street chain.

TheIndustry.beauty has taken an in-depth look at The Body Shop, with exclusive commentary from industry experts and analysts to gauge their opinions on its future, as well as what went wrong.

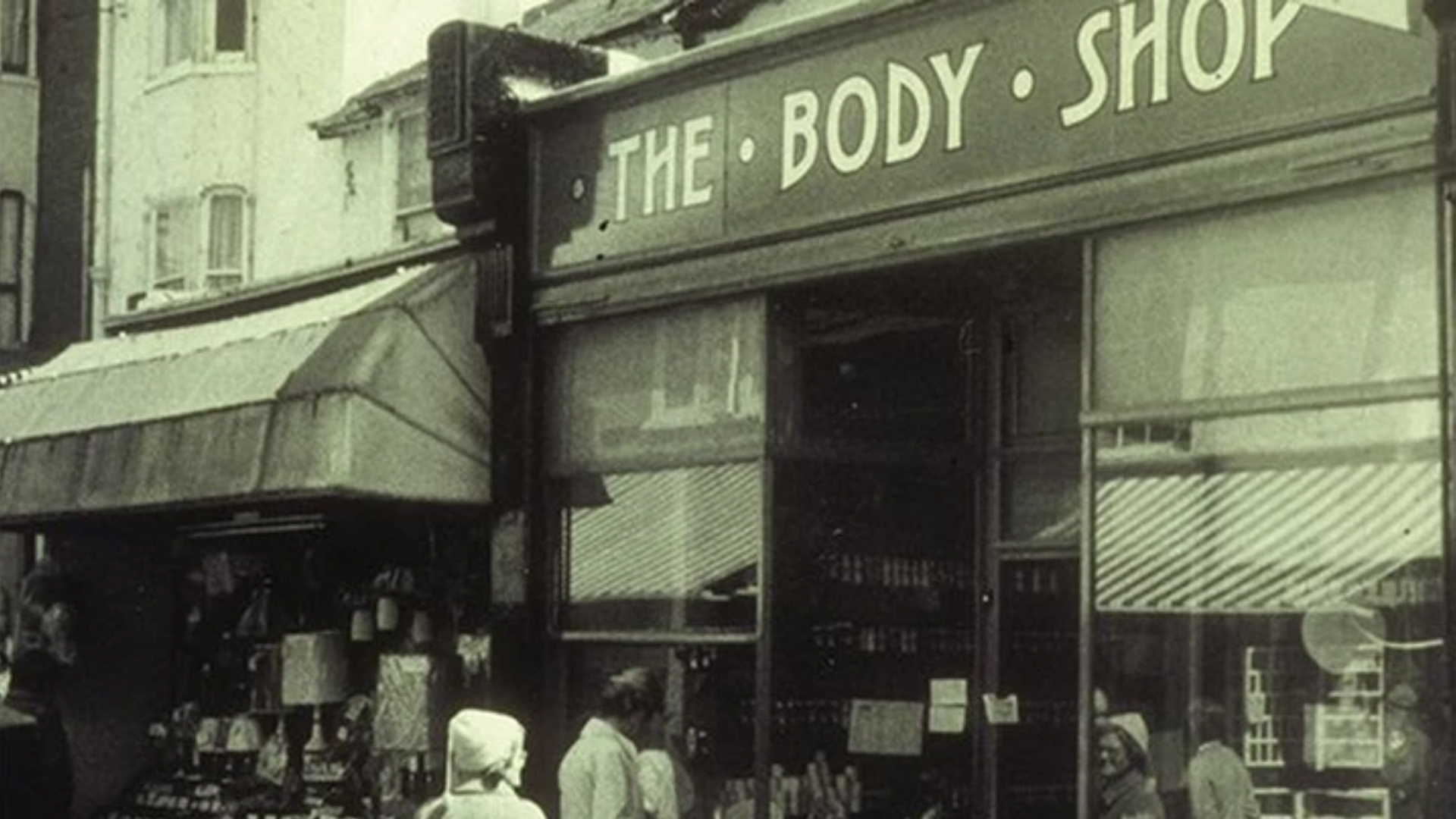

Founded in 1976, The Body Shop began with founder Dame Anita Roddick and her belief that business could be a force for good. The brand first opened with a little green-painted shop in Brighton and has since grown into a global business serving over 30 million customers worldwide.

With Roddick's passion for the planet and campaigning, The Body Shop has always been more than just a beauty brand. Its approach to beauty was radically different from that of the big players in the industry 48 years ago.

The brand set out to champion ethically sourced, natural ingredients with no-nonsense packaging, making sure its products were never tested on animals and didn’t exploit anyone in making them. Combined with its activism, this point of difference contributed to The Body Shop's early growth.

In 2006, at the height of its success, The Body Shop was acquired by L'Oréal. However, over the next 11 years... it failed to thrive.

The business was then acquired by Natura & Co in 2017, which implemented various initiatives, such as new packaging designs and refill schemes, in an attempt to return the brand to its former glory.

As part of this strategy, The Body Shop developed a new concept for its stores to better promote the activist roots of Roddick. Launching at various locations, including London's Oxford Street, the updated design reflects the brand's ethical and eco-friendly values and aims to offer an improved customer experience for those shopping its portfolio of products.

The brand also re-launched its makeup category in April 2023 with a new collection of cruelty-free, vegan and high-performance cosmetics.

This came amid the departure of CEO David Boynton, who was replaced by Natura & Co Board Director Ian Bickley on an interim basis to "help refine the current business plan and transformation agenda, as well as accelerate profitability and return to sustainable revenue".

Despite all of this, sales at The Body Shop continued to decline. The brand's revenue decreased 13.3% in constant currency to £132.7 million (BRL829.4 million) in the third quarter of 2023. Combined sales from stores, e-commerce and franchise also showed a high single-digit decline.

This drop in sales also extended to the other quarters in the year, as net revenue was down 12.5% in Q2 and 9.4% in Q1, as well as in 2022.

As Natura & Co struggled to improve The Body Shop's performance, rumours of a potential sale then began to arise in August 2023.

Fast forward to November 2023, and the Brazilian beauty group agreed to sell The Body Shop to private equity firm Aurelius. At the time, Aurelius said that, despite the challenging retail market, there was an opportunity to "re-energise" the business and allow it to take advantage of positive trends in the high-growth beauty market.

Since its takeover in December 2023, the firm has been working closely with The Body Shop to develop a "strong, long-term strategy, supported by the right structure and operating model".

It confirmed the departure of Bickley as Interim CEO last month, whilst initially focusing on the brand's separation from Natura & Co and continuing the transformation planned last year (including the closure of 'The Body Shop At Home' scheme after 30 years).

Within the last few weeks, The Body Shop also announced the sale of parts of its international business in mainland Europe and Asia.

"The sale is another decisive step towards delivering a strong turnaround strategy for The Body Shop, supported by the right structure," read a statement at the time. "The ambition is to create a modern and dynamic beauty brand, relevant to customers and able to compete for the long term."

It seems this strategy has not gotten off to a great start, though, with Aurelius now looking to appoint administrators in the coming days.

What do the experts think?

Millie Kendall OBE, CEO of The British Beauty Council:

I think I have been quite vocal about the fact that The Body Shop has been missing an activist at the helm for some time. A lot of brands will have a creative director, and The Body Shop has been missing someone at the forefront of sustainability leading the brand.

It has missed such a great opportunity to reach the new youth, the Greta Thunberg devotees, as The Body Shop was always the leader in cruelty-free cosmetics and natural beauty.

Sallie Berkerey, Managing Director of CEW UK:

As a child of the 80s, The Body Shop holds a special place in my heart, as we had never seen a brand of this kind in the market. It was unique and remains much loved - a pioneer in ethical beauty with a clear, revolutionary ethos that challenged the industry's status quo at that time – a brand that put people and the planet first.

The news that the UK business has entered administration is a pivotal point in the brand's story and will undoubtedly be a moment of reflection for the wider industry. As a brand that was at the forefront of purpose-led, ethical beauty, many brands have since followed, and of course, the retail landscape has also transformed dramatically and continues to do so. The pressure on brands to continue to evolve has never been more intense, and this news is a stark reminder of the pitfalls of not doing so.

With its strong heritage, there is undoubtedly a chance for Body Shop to move on from this, but it needs to reimagine how its customers experience the brand and how to engage with the next generation. Whether this is through the use of technology, innovation or new ways of presenting the brand and engaging with customers and building community or, indeed, all of the above remains to be seen.

Certainly, there is a lot of support for The Body Shop to reclaim its position as one of the pioneers in putting purpose, people and the planet first, and I, for one, hope that this is not the end for The Body Shop but the start of a new chapter.

Wizz Selvey, Consumer & Retail Trend Analyst:

It’s a surprise to see The Body Shop appoint administrators so soon after it was acquired, but there may be a silver lining to the future of this iconic brand. By appointing administrators, the business will be pulled apart, assets may be sold and some of the more profitable areas of the business will be left to be focused on. We have seen this done with high-street names such as Wilko and Made.com recently, where the brands live on but under different management and ways of retailing to the customer. There could also be the opportunity to sell the brand name and IP similarly to what we saw with Paperchase and Hunter last year.

The Body Shop is a heritage brand but no longer has the ‘cool’ factor it did in the 70s and 80s. When it launched, The Body Shop was way ahead of the trends and for decades afterwards, but as the market evolved and brands overtook The Body Shop, it lost its point of difference. There are now numerous brands with ethical values, and truly, all brands must have ethics and a mission as part of their business for success in the future market.

Ultimately, The Body Shop needs to invest in further developing its point of difference to succeed. Remodelling the business will only take it so far. It has already been left behind in the market, customers are not engaged compared to other brands, it needs to create an emotive connection with customers again. The only way is to reposition itself in a swiftly evolving market, as well as focus on a unique customer experience that gives customers a reason to enter their shops or shop online.

I don’t think this is the last we will see of The Body Shop, but it needs to operate, look, feel and act very differently to survive.