THG is no stranger to the press and now it's bought it. Why?

Will THG CEO Matt Moulding become the Jeff Bezos of protein powder? While not exactly the Washington Post (which the Amazon founder acquired 10 years ago), Moulding, another tech entrepreneur, and his online giant, THG, has bought London’s financial freesheet newspaper City AM.

In a surprise to the market, the struggling City AM was snapped up THG, formerly The Hut Group, which describes itself as "a vertically integrated, digital-first consumer brands group, retailing its own brands in beauty and nutrition, plus third-party brands, via its complete digital commerce solution, Ingenuity, to an online and global customer base."

City AM co-founder Lawson Muncaster said the deal represented a ‘perfect fit’ for the business. “We both believe firmly in the power of business to make peoples’ lives better and we cannot wait to get started with our new partners,” he said in City AM.

The article continued: “THG, which already publishes digital magazines with a combined circulation of 600,000 through The Supplement and The Highlight, has been looking for a partner in the media space for some time, the firm’s chief exec Matthew Moulding said”.

Matthew Moulding

The newspaper was purchased in a pre-pack deal from appointed administrators BDO. “City AM is one of London’s leading media platforms and we will ensure this remains the case with full editorial independence. This deal helps us reach a huge new audience, complements our successful content creation studios and digital media expertise,” Moulding said.

The 18-year-old newspaper reports around 2 million monthly unique visitors online and a daily print circulation of under 70,000 Monday to Thursdays. It stopped its Friday edition in January 2023 when it realised the return to the office didn’t include the last day of the working week.

THG, and in particular Moulding, has had a fractious relationship with the City since its IPO in September 2020. It was valued at £5.4Bn at the time. The shares have tanked since then, floating at 500p and is now worth around 103p. Currently, THG retail brands such as LookFantastic, Glossybox, Zavvi, Cult Beauty, MyProtein and Coggles help to generate £2.2bn of annual revenue in 2022, up 2.7%.

Moulding has never been able to charm the City. One disastrous investor presentation in October 2021 saw a 35% dip in the share price. Even Moulding’s mother went on to round on Sunday Times journalist Oliver Shah in defence of her son’s achievements. It was reported an email sent stated: “The Hut Group’s matriarch wanted to know why writers were not more appreciative of her son’s “outstanding” achievements. “You must lead very dreary lives in your dead-end jobs,” she remarked.

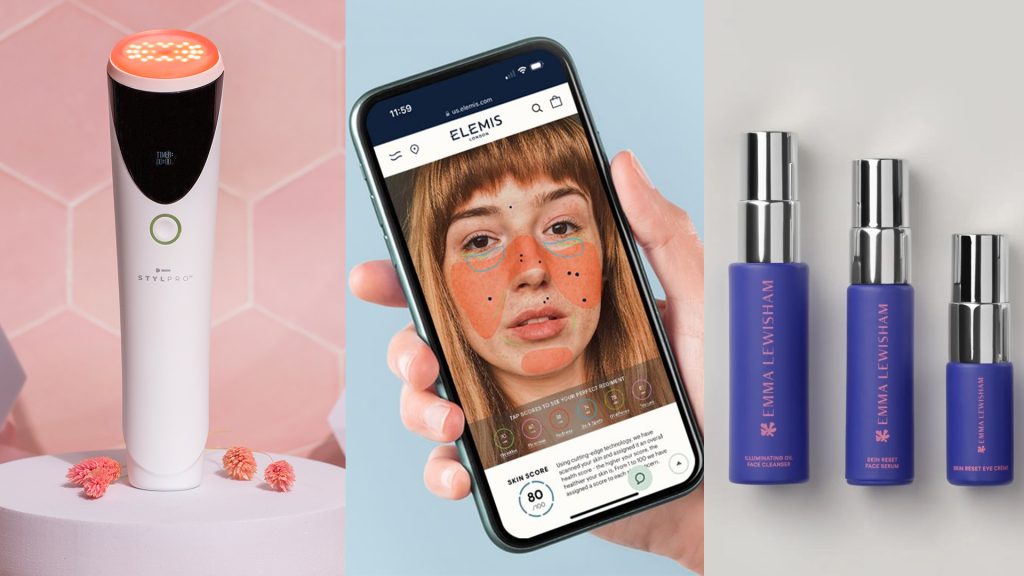

THG's Cult Beauty

Much noise has centred around Moulding’s emperor-like ‘golden’ share, which allowed him veto powers over changes to the company's charter. It holds special voting rights, giving its holder the ability to block another shareholder from taking more than a ratio of ordinary shares. Moulding relinquished his ‘golden’ share in June 2023.

He has grown the company since 2004 into one of the UK’s online unicorns. Despite increasing revenues, Moulding never managed to garner the confidence of the City and its investors.

So, Is the answer to bad press buying a newspaper? The company is often negatively reported and Moulding unwisely thought he could outperform the doomsayers. Losing his ‘golden’ share and buying City AM could be his way of saying ‘if-you-can’t-beat-them-join-them’. Moulding’s fractious relationship with the City has affected its share price and any goodwill. Rescuing one of London’s most well known financial media companies could be seen as a token gesture to finally acknowledging his is trying to understand how the City works.

No doubt City AM was going for a song and it does have lifestyle content. It did have a magazine at one time.

City AM says it has a premium and influential audience. Both its print and online audiences are mainly ABC1 (upper and middle class) with a “higher than average” disposable income, according to its current editor. THG could look to expand the title to other cities like its home base in Manchester or other financial centres like Leeds or Edinburgh. It could also tap into smaller investors who exploded in numbers during the pandemic. Expanding the lifestyle sections would also suit many of THG’s retail brands.

It’s a strange fit, but why not?